Claims Adjuster

AI for Claims Adjusters: Boosting Efficiency with 10 Key Examples

There's been a lot of talk about Artificial Intelligence (AI) for a while now. Strip away the jargon, and a key question remains: How can AI tools really fit into your claims process to make things smoother and more efficient?

Here's a practical scenario: A homeowner sends in a video showing hail damage to their property. Instead of someone having to watch the whole thing, an AI tool quickly checks it out. It understands the damage, and before you know it, the right adjuster is on the job. No fuss, no delay.

The biggest takeaway? AI is cutting down time and effort in the claims process. This means quicker responses and less manual work for professionals like you, and homeowners get their claims resolved faster.

In this guide:

- Understanding the Inner Workings of AI Models

- 10 Ways to Use AI Tools as a Claims Adjuster

- Advantages of AI for Claims Experts

Understanding the Inner Workings of AI Models

In the world of property claims, adjusters can utilize a diverse range of AI tools that employ different models to enhance their processes and make well-informed decisions. Here's a brief summary of how these AI models operate:

- Predictive: Predictive modeling is about forecasting outcomes based on input data. In claims adjusting, it can be used to forecast the potential cost of a claim based on initial information. For instance, given the extent of a roof damage, they can predict how much it might cost to repair.

- Generative: These models could be trained on a dataset of past fraudulent claims, learning the characteristics that often signify fraudulent activity. Once trained, it could generate new, synthetic fraudulent claims scenarios.

- Discriminative: These models could be used in the classification of claims. For instance, claims could be classified into categories like "likely fraudulent", "high cost", "low cost", "quick resolution", "lengthy resolution", etc.

To give a practical analogy within the industry:

A predictive model in this industry is like an adjuster who, upon hearing the initial details of a claim, estimates the time it will take to process, the potential cost, or the likelihood of complications arising.

A generative model in claims adjusting might be like an adjuster who has been trained on various types of claims and can generate a detailed hypothetical scenario for a training exercise, giving a rich description of what might have happened.

A discriminative model would be like an adjuster who is particularly skilled at telling whether a claim is more likely to be due to one cause or another based on the presented evidence.

10 Ways to Use AI Tools as a Claims Adjuster

Moving forward, let's delve into 10 AI tools and applications that are streamlining the tasks of claims adjusters:

1. Computer Vision

2. Fraud Detection

3. Automation of Routine Tasks

4. Enhanced Training & Onboarding

5. Claim Complexity Scoring

6. Optical Character Recognition (OCR)

7. Document Explanation

8. Quality Assurance

9. Predictive Analytics

10. Assisted Note-Taking

Computer Vision

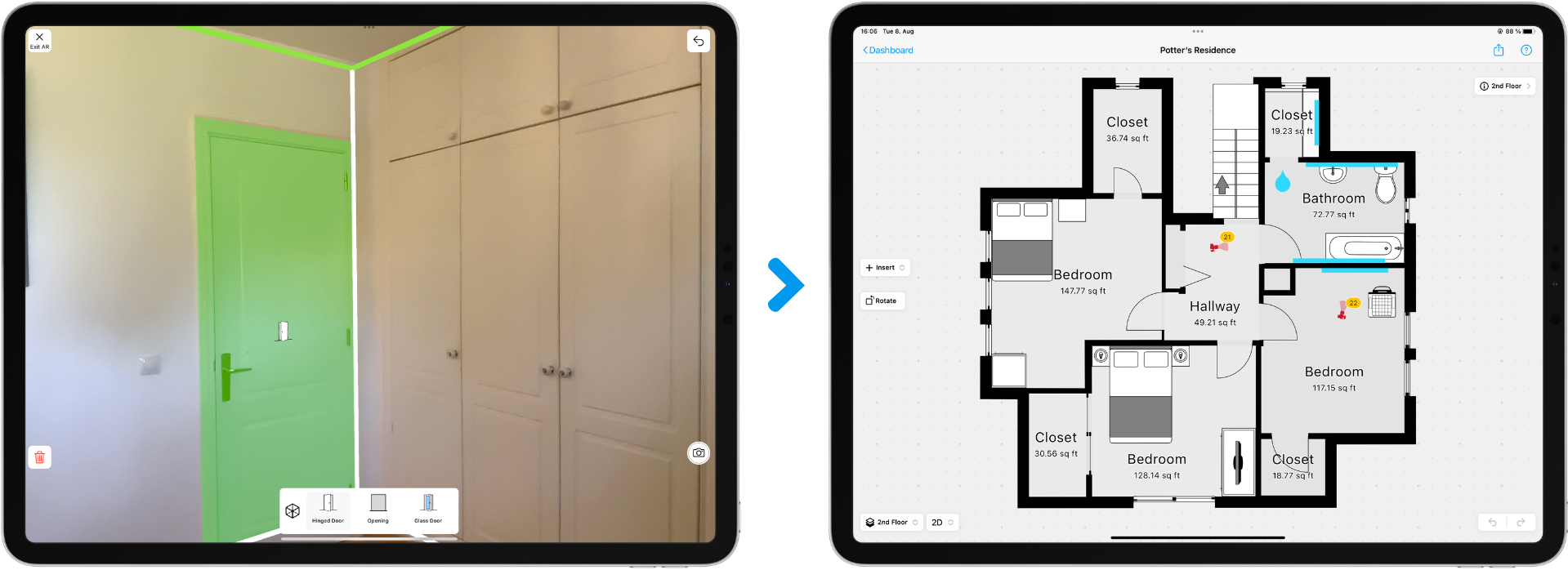

Computer vision is the science of making computers interpret and understand visual data from the world, much like how humans use their eyesight and brain in tandem. It involves teaching machines to process and interpret visual information, drawing insights from digital images or videos. This can range from identifying objects in an image to understanding patterns and anomalies.

Example: With magicplan, you have the power to effortlessly scan an entire property in seconds and recognize and measure various objects like windows, doors, and more, all with the convenience of your mobile device or tablet.

Fraud Detection

Fraud detection is a method where AI sifts through vast amounts of claims data to identify inconsistencies or patterns that signal deceit. It goes beyond just spotting duplicates or glaring errors; it can identify subtle, hidden patterns that might suggest fraudulent activity.

Example: Verisk’s image fraud detection analytics, powered by AI, enables you to quickly identify when and where photos of damages were taken, and if they’ve been used in previous claims, copied from websites, or altered digitally.

Automation of Routine Tasks

Automation, in the context of AI, means the machine handles tasks without human intervention. These are often repetitive tasks that, while simple, can be time-consuming when done manually. By automating them, consistency is maintained, and human error is reduced.

Example: There are many AI-based Damage Detection Tools that allow adjusters to save minutes per job and hundreds of hours per year by saving time with AI-assisted visual inspections that recognize the type of damage immediately.

Enhanced Training & Onboarding

AI-powered training platforms, especially chatbots, offer dynamic and interactive learning experiences tailored to the learner's pace. These AI chatbots can simulate real-world scenarios, answer questions in real-time, and even test a trainee's knowledge, ensuring a consistent and in-depth learning experience.

Example: ChatGPT can be an excellent tool for training new claims adjusters. It can be programmed with extensive knowledge from an insurance database, serving as a readily available source of information for trainees.

Claim Complexity Scoring

This involves analyzing all facets of a claim and assigning it a score that indicates its complexity. It's a way of triaging claims so that adjusters can prioritize their workload, tackling the most demanding cases first or delegating simpler claims accordingly.

Example: Specific AI platforms can analyze the nuances of a claim and rank them, allowing adjusters to see which claims need immediate attention.

Optical Character Recognition (OCR)

OCR technology is a bridge between physical and digital realms. It reads printed or handwritten text – think of scanned documents or photos of documents – and turns them into machine-readable, digital text. It essentially converts static, physical information into dynamic, searchable, and editable data.

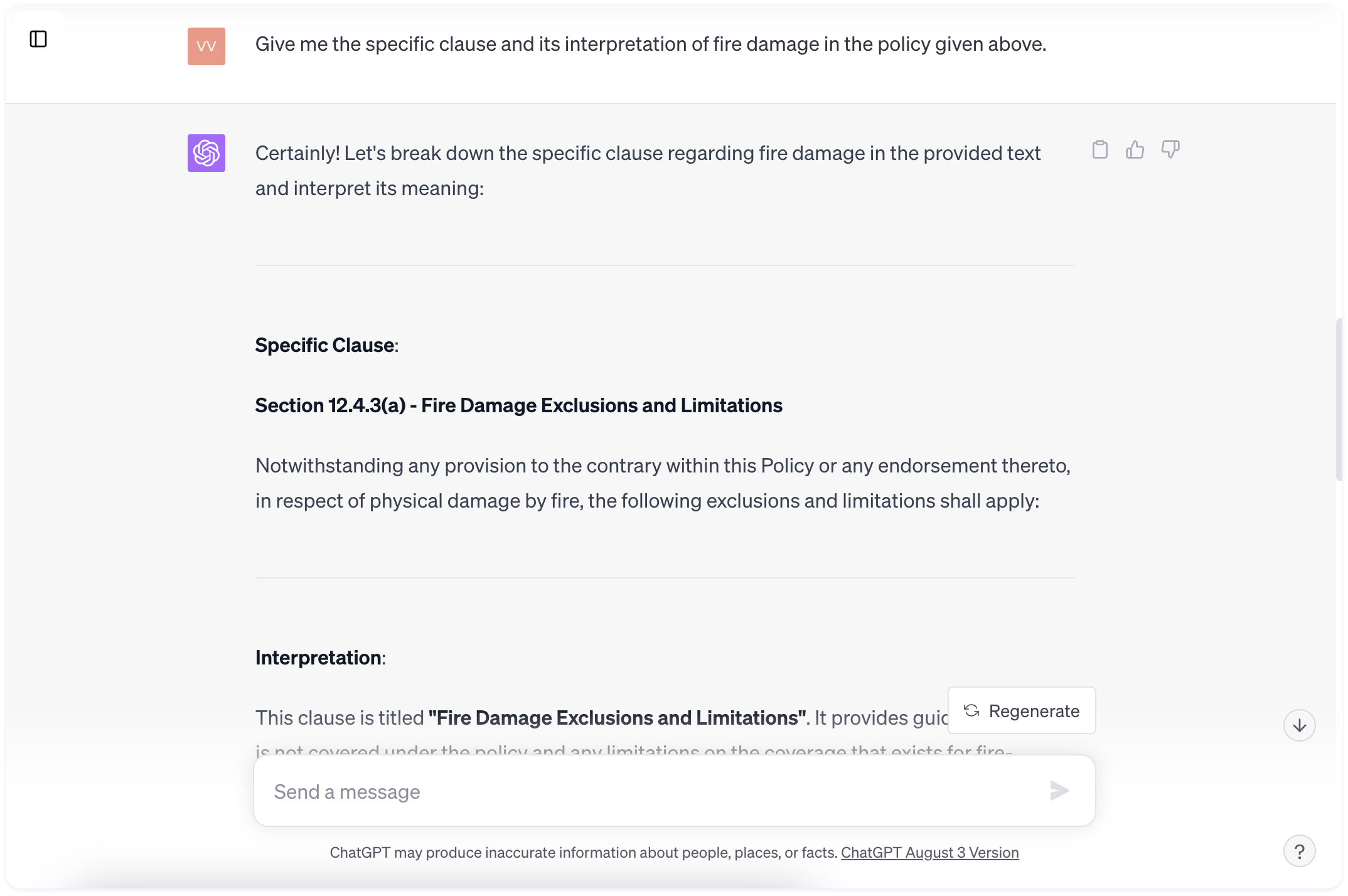

Document Explanation

Some AI can swiftly pull specific clauses from complex insurance documents based on an adjuster's query, streamlining the adjustment process. Also they can quickly summarize lengthy documents, enabling adjusters to grasp key points without having to read through entire policies.

Example: If an adjuster inquires about "fire damage in policy XYZ", it can immediately provide the specific clause and its interpretation. Or, if there's a new policy update, tools like ChatGPT can provide a concise summary, highlighting changes and important clauses.

Quality Assurance

After interactions have been conducted or decisions have been made, AI can be used as a feedback tool, helping adjusters understand if they have missed any critical points or if there are areas for improvement where AI tools can help find win-win outcomes between the adjuster and the claimant by taking into account a wider range of factors and data.

Example: If an adjuster's assessment of a claim seems off-base compared to similar past claims, the system provides a gentle nudge to double-check their evaluation.

Predictive Analytics

Predictive analytics harnesses AI's power to analyze past data and predict future outcomes. In claims, this means understanding past claim resolutions and using that data to estimate costs or timelines for new claims.

Example: Gradient AI employs this approach, offering adjusters potential forecasts based on historical data.

Assisted Note-Taking

This application of AI revolves around the real-time transcription of spoken words into written text. The AI listens to human speech, understands context, nuances, and even different accents, and then quickly turns that into a legible record.

Example: Otter.ai showcases this, capturing every detail from spoken conversations and converting them into text.

Advantages of AI for Claims Experts

1. Decreased Cycle Time: With the implementation of AI, the analysis and damage assessment process are automated, leading to a significant reduction in the overall time it takes to process a claim. This is a stark contrast to the traditional approach that heavily relies on manual inspections and assessments, which tend to prolong the claim life cycle.

2. Increased Accuracy: AI tools offer precise and unbiased evaluations of damage, significantly reducing the risk of human mistakes and improving the accuracy of claim settlements, ultimately preventing financial losses.

3. Optimal Resource Allocation: By intelligently analyzing the intricacies of a claim, AI can determine the exact number of adjusters required for field assessments, ensuring no understaffing or wastage of resources. Additionally, it can identify and match claims with the best-suited contractors in the vicinity, based on factors like expertise, availability, and past performance.

4. Efficiency and Flexibility: By taking care of repetitive tasks, AI allows adjusters to invest their time in more complex claim components, fostering both efficiency and flexibility.

In essence, AI isn't just a buzzword or a fleeting trend. For claims professionals, it's a game-changing tool that ushers in efficiency, accuracy, and innovation. As the landscape of claims processing continues to evolve, the integration of AI will undoubtedly be at its forefront.

Continue reading our guide on How Every Home-Insurance Claims Adjuster Can Reduce Cycle Time

Or find out more about Embracing the Future of Home Insurance: The Rise of Virtual Claims

Related articles

Sam Miller

Sales Operations Consultant