Claims Adjuster

How Every Home-Insurance Claims Adjuster Can Reduce Cycle Time

As a remote claims adjuster, you know that one of the biggest challenges in your job is reducing claim life cycle time. You’re expected to manage each claim as swiftly as possible. Fortunately, there are tools available that can help you streamline your claims workflow process. One of those tools is a floor plan app. In this blog post, we’ll explain why and how you should use a floor plan app to document damage in claimants’ homes.

The Importance of Efficiency in Claim Cycle Time

The claim cycle time starts from the moment a claim is reported and ends when that claim is settled. Keeping this time span short is crucial for both insurers and policyholders:

- Longer claim settlement cycles result in higher costs for insurers, and can have a negative impact on profitability. So, shortening the cycle time is a smart strategy, because it helps to reduce claim costs. This gives insurers the freedom to price their premiums competitively without forgoing profitability.

- By reducing the claim cycle time, insurers can provide faster service. That improves customer satisfaction considerably and also strengthens customer loyalty, because customers appreciate avoiding long and complex claim resolutions. They want a claim experience that is simple, stress-free and resolved quickly.

In short, a reduced cycle time is a win-win situation for both insurers and their customers!

So now, the big question for you is this: How can you, as a remote claims adjuster, help reduce the cycle time? Well, a lot of it has to do with how you document property damage.

Old-School Documentation Methods Will Slow You Down

Traditionally, adjusters have relied on measuring rooms manually, sketching floor plans on paper, and then later converting those plans into digital formats. This process is time-consuming and often prone to errors. Inaccurate measurements or missing details can lead to delays and misunderstandings during the claims settlement process. Additionally, floor plan creation can be challenging for large or complex properties, requiring multiple visits and prolonged claim cycle times.

In Contrast, a Floor Plan App Gives You the Power to Work Faster

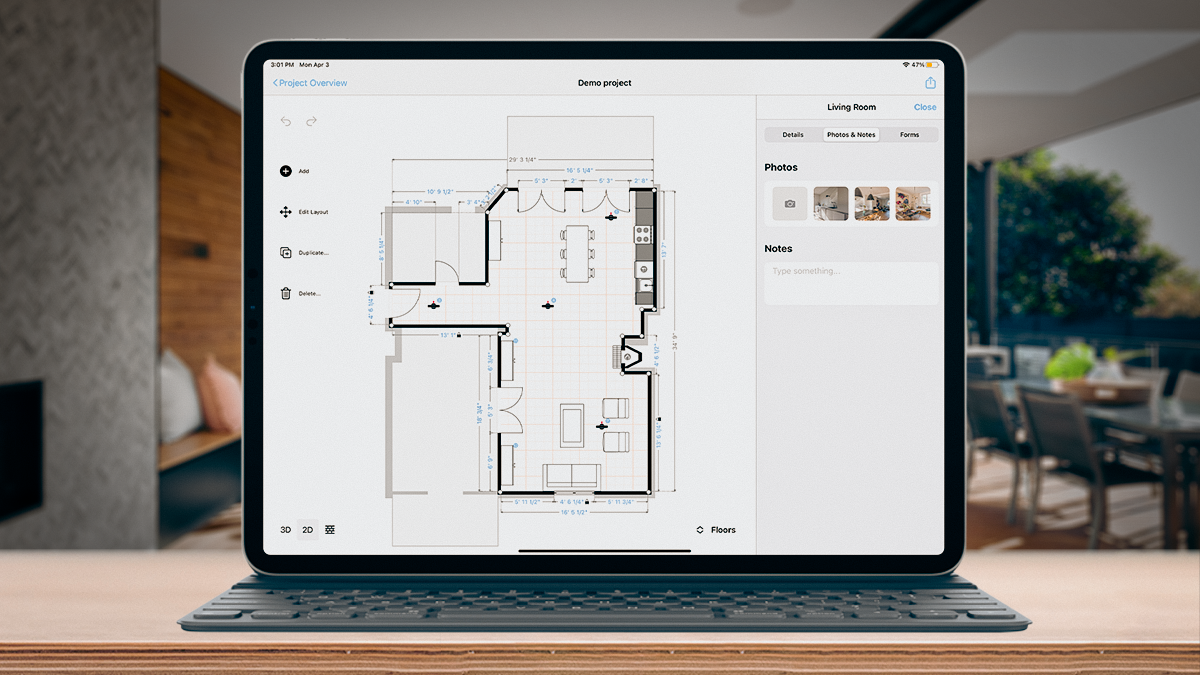

A high-quality floor plan app offers a revolutionary solution for documenting home-insurance claim inspections. It’s a mobile software tool that works with your device’s camera, and uses augmented reality and artificial intelligence technology to draw floor plans for you.

For example, magicplan is a user-friendly app that enables you to create detailed floor plans quickly and effortlessly. You can use it to capture measurements, generate floor plans of rooms within minutes, and mark any property features or appliances that may have been damaged. You can also attach photos to your floor plans for additional visual documentation.

Learn more: The fastest way for claims professionals to export floor plan sketches directly to Xactimate®

A Floor Plan App is One of the Best Insurance Adjuster Tricks for Saving Time

By downloading and using a floor plan app, you can eliminate the time-intensive tasks of manually measuring and sketching. As a result, you can streamline the claims assessment process significantly.

It Improves Accuracy to Help You Avoid Drawn-Out Disputes

Efficiency is not just about speed. It’s also about accuracy. The more precise and comprehensive you make your property assessment documentation, the faster the decision-making process will lead to fair and prompt settlements. Using a digitized approach for measuring and sketching eliminates manual errors. It also minimizes the need for revisits, and can help you avoid disputes with policyholders and contractors, to help speed up the claims process.

It Accelerates Communication and Collaboration

That’s because a good app will allow you to easily share your generated floor plans and photos with relevant parties, including contractors or other adjusters. This streamlined communication facilitates prompt decision-making, speeds up the settlement process, and reduces the need for additional back-and-forth interactions.

Bonus Benefit: Greater Security

Using a digital floor plan app will reduce the risks associated with paper-based manual documentation.

The Key is to Choose the Right App

There are several different floor plan apps available, so it’s important to choose one that meets your specific requirements. Look for an app that is easy to use, accurate, and allows you to customize your floor plans to include the information you need to assess and document claims. You’ll also want a floor plan app with a reporting function, so you can create and share structured reports easily and quickly. This will help ensure that everyone involved with a claim has access to the same information for more efficient processing.

And here are three additional features to look for in an app:

- The ability to connect with a Bluetooth laser distance measurer for near-perfect measurement accuracy

- A handy, built-in library of objects that you can use to add details to your floor plans

- An optional cloud service for storing, securing and accessing plans

Get Started: Download a Floor Plan App Now as the Catalyst for Faster Cycle Times

A floor plan app can be a game-changer when you’re working as a remote claims adjuster. By leveraging this type of digital tool, you can speed up documentation to help reduce claim cycles. So, why wait to get started? Embrace a good floor plan app today and revolutionize your claims adjustment process!

LEARN MORE: Read 5 Ways to Optimize Your Productivity as an Independent Claims Adjuster

Related articles

Zuzanna Geib

Team Lead Marketing